As one out of every 3 Filipinos is now using the app, GCash sets its eyes on achieving more game changing milestones to uplift the lives of many and contribute to building an even stronger and more robust Philippine economy.Appendix B: Composition of SMART and GCASH Ecosystems 17 Acknowledgements The author would like to thank the entire team of both SMART and Globe for facilitating site visits and providing valuable context for this paper. The company boasts of its wide network of more than 2.5 million merchant partners and social sellers via its QR and P2P features, enabling the app to cater to a diverse set of stakeholders in the country. GCash, the Philippines’ undisputed no.1 mobile wallet app, provided the bright spot for Southeast Asia at this year’s Qatar Economic Forum, an international gathering of global business leaders, heads of state and policy innovators coming together to look forward as the world emerges from the economic shock created by the COVID-19 pandemic.Enjoy international money transfer to bank accounts in Australia, China, Vietnam, Singapore, India, Bangladesh, Nepal, Thailand, the Philippines & Indonesia.This year, GCash processed an average of PHP 300 billion in monthly transactions, and is on track in breaching its PHP 3 trillion Gross Transaction Value (GTV) target.

GCash is also one of Asia's top 1,000 brands this 2021.Asia's Top 1000 Brands is a consumer opinion survey across 14 markets in Asia-Pacific and measures brand preference in 15 product/service categories. Online Payments Mobile Payments.The fintech brand was recently included in the Top 100 Brands in the Philippines, according to Campaign Asia-Pacific and NielsenIQ. Mobile e-wallet to send and receive money and pay bills.

Gcash International Free Money Transfers

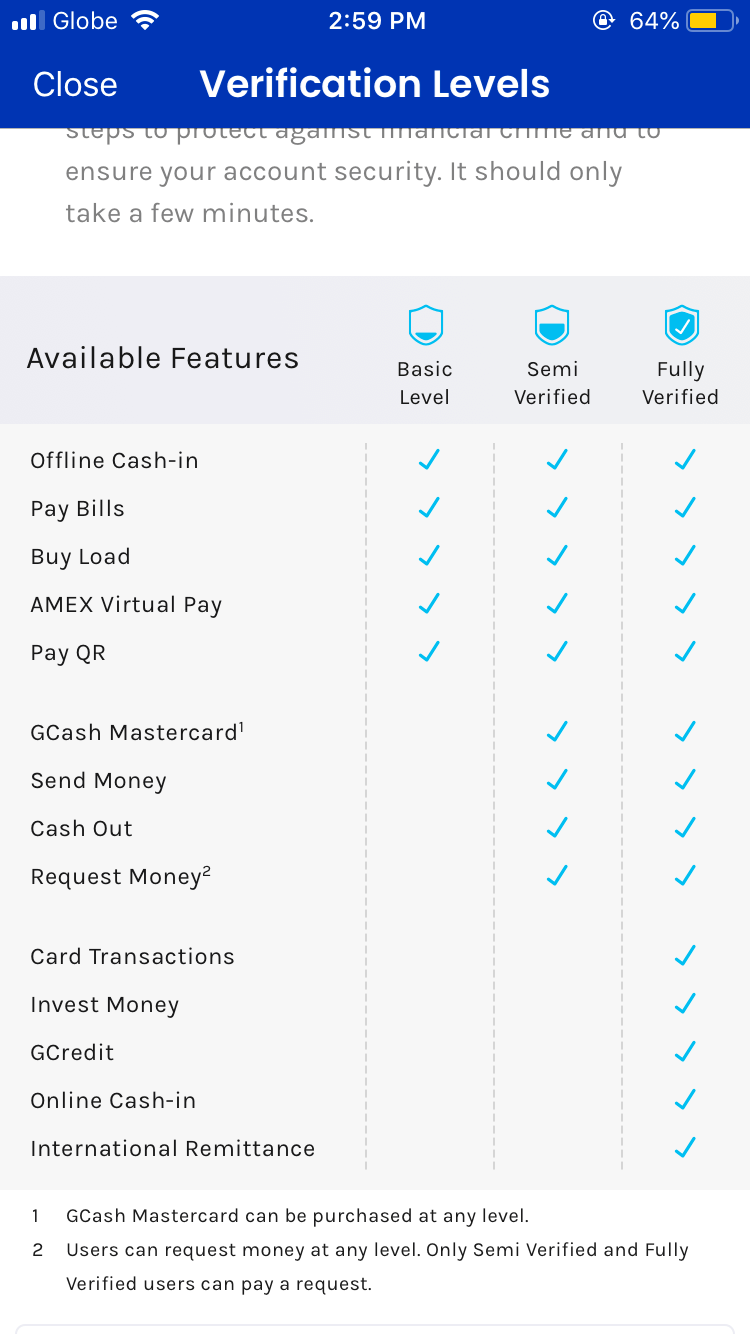

GCash provides customers easy access to a pre-approved credit line to pay for bills or QR transactions with GCredit, safely deposit money with GSave, easily invest in a market fund with GInvest, and buy essentials on GLife. The mobile wallet company also offers businesses, especially MSMEs, a contactless way to accept payment for goods through the use of QR codes and its P2P platform, which has empowered over 2.5 million GCash merchants and social sellers.Currently, a third of GCash's monthly active users utilize at least one of the app's digital products like GCredit, GSave, GInvest, or GInsure. Among the high-ranking brands in the list are Samsung, Apple, LG, Sony, Panasonic, Nike, Nestle, Google, Colgate, and Starbucks.Solidifying customer experience through value-adding servicesGCash provides customers with an easy and secure cashless payment platform through digital products and services like free money transfers from user to user, frictionless bank transfers, and bills payments. This award further inspires us to continue with our mission to empower as many Filipinos as possible by giving them access to digital financial solutions that can make their lives better and more convenient especially during this pandemic," said Martha Sazon, President and CEO of GCash.No other fintech brand made it to the top 50 of the prestigious list, where the ranking of GCash rose from the previous year's 51st spot to this 24th in the country in 2021. This year's study saw the changing consumer behavior among brands and their increasing digital services."We are honored to be part of the top brands in the Philippines and in Asia.

GCash is a wholly-owned subsidiary of Mynt (Globe Fintech Innovations, Inc.) since 2015.GCash was recognized by The Asian Banker (TAB) in 2021 for its outstanding digital financial inclusion programs impacting more than 46 million Filipinos in the country today.Vice President, Corporate Communications and Public AffairsSOURCE GCash (Mynt - Globe Fintech Innovations, Inc. Through the GCash App, customers can easily purchase prepaid airtime pay bills at over 600 partner billers nationwide send and receive money anywhere in the Philippines, even to other bank accounts purchase from over 2.5M partner merchants and social sellers and get access to savings, credit, insurance and invest money all at the convenience of their smartphones.

0 kommentar(er)

0 kommentar(er)